Rent to own mobile homes offer a life-changing opportunity for people like Sarah, who always dreamed of owning a home but felt it was beyond her reach. Like 20% of Americans, Sarah believed that saving enough for a down payment was nearly impossible. But everything changed when she discovered rent-to-own mobile homes—a flexible way to turn her dream into reality.

This unique approach allows individuals to rent a mobile home with the option to buy it later. A portion of each month’s payment goes directly toward the eventual purchase, making the path to homeownership more achievable for those facing financial barriers.

For many, like Sarah, rent-to-own agreements provide a realistic chance to break into the housing market. With the national median home price hovering around $353,900, traditional homeownership can seem out of reach. Rent-to-own deals ease this burden by allowing a part of the monthly payments to contribute toward the down payment when the lease ends, making the journey to owning a home both possible and financially manageable.

If you are interested to Calculate your Mobile Home Mortgage. Find More Here.

Table of Contents

Key Takeaways

- Rent-to-own mobile homes provide a path to ownership for those with financial challenges

- 20% of potential buyers feel they may never save enough for a down payment

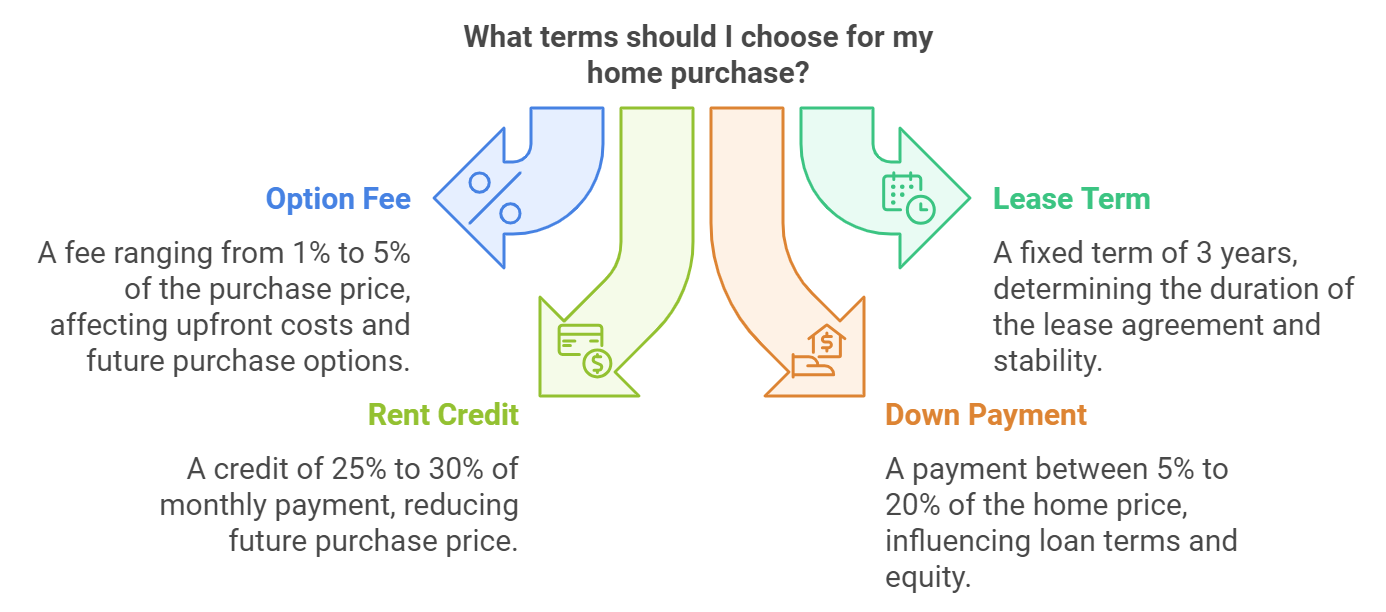

- Rent-to-own agreements usually require an upfront fee of 1% to 5% of the purchase price

- A portion of monthly rent goes towards the eventual purchase in rent-to-own contracts

- Rent-to-own options are suitable for those with credit issues, lack of savings, or irregular income

- Contracts are divided into lease-option and lease-purchase agreements

- Renters may pay premium rates due to rent credit allocation towards purchase

Understanding Rent-to-Own Mobile Homes

Rent-to-own mobile homes are a unique way to become a homeowner. They are becoming more popular for those looking to rent mobile homes. This option combines renting and buying, offering benefits to many.

Definition of rent-to-own agreements

A rent-to-own agreement for mobile homes has two main parts: a rental lease and a purchase option. Tenants sign a lease that lasts from one to several years. They pay an option fee, usually 1-5% of the home’s price, and monthly rent. This rent includes a “rent credit” towards the home’s purchase.

How rent-to-own differs from traditional home buying

Rent-to-own lets you live in the home before you own it. It gives you time to improve your credit or save for a down payment. The home’s price is set at the start and doesn’t change during the lease. At the lease’s end, you can buy the home using your rent credits.

Types of mobile homes eligible for rent-to-own

Many types of manufactured homes can be rented with an option to buy. These include:

- Single-wide mobile homes

- Double-wide mobile homes

- Triple-wide mobile homes

- Park model RVs

| Feature | Rent-to-Own | Traditional Buying |

|---|---|---|

| Upfront Costs | Option fee (1-5% of price) | Down payment (10-20% typical) |

| Occupancy | Immediate | After closing |

| Ownership Transfer | At end of lease term | At closing |

| Price Lock | Yes, set at agreement start | No, subject to market |

Rent-to-own agreements for mobile homes can be a first step to owning a home. They offer flexibility and the chance to build equity while renting. But, it’s important to know the terms and responsibilities before signing.

The Rent-to-Own Process for Mobile Homes

The mobile home rent-to-own process is a special way to become a homeowner. It begins with making lease-option agreements. These agreements outline the terms of the deal. They usually last three years and cover monthly rent, purchase price, and who does maintenance.

At the start, tenants pay an option fee, which is 1% to 5% of the home’s price. This fee lets them buy the home at the end of the lease. Rent payments in these deals are higher than usual, with 25% to 30% going towards the down payment.

During the lease, tenants can work on improving their credit scores and saving money. It’s key to know who does maintenance, as some deals require tenants to handle repairs. At the lease’s end, tenants can use their rent credits as part of the down payment to buy the home.

If tenants decide to buy, they get financing from local lenders who know about mobile home deals. Rent-to-own listings for mobile homes are not common. They usually happen when homes have been on the market for a long time.

Financial Aspects of Rent-to-Own Mobile Homes

Rent-to-own mobile homes are a special way to become a homeowner. This option has different financial parts than buying a home the usual way. Knowing these parts is important for making a smart choice about rent-to-own mobile home financing.

Option Fees and Rent Premiums

Option fees are the upfront costs in rent-to-own deals. They can be 1% to 5% of the home’s price. For example, on a $150,000 home, you might pay $1,500 to $7,500.

Rent premiums are extra money you pay each month. This money helps with your down payment later on.

Rent Credits Explained

Rent credits are a part of your monthly payments that go toward the home’s price. About 25% of your rent payment is a rent credit. Over time, these credits can lower the home’s price a lot.

Purchase Price Considerations

The home’s purchase price is set at the start of the lease. This protects you from price hikes later. Some deals let the price be decided by an appraisal at the lease’s end.

| Aspect | Typical Range | Example |

|---|---|---|

| Option Fee | 1-5% of purchase price | $1,500 – $7,500 on $150,000 home |

| Rent Premium | 10-15% above market rate | $150 – $225 on $1,500 rent |

| Rent Credit | 25% of monthly rent | $375 on $1,500 rent |

It’s key to understand these financial parts when looking at rent-to-own mobile homes. Make sure to read all the terms well. It’s also wise to get legal advice before signing any agreement.

Legal Considerations in Rent-to-Own Mobile Home Agreements

Rent-to-own mobile home contracts have unique legal aspects. They offer a way to own a home but need careful thought. It’s important for both buyers and sellers to understand the legal side.

There are two main types of agreements: lease-option and lease-purchase. Lease-option lets renters choose to buy later. Lease-purchase makes them commit to buying at the end. State laws differ, affecting who fixes things and what happens if payments are late.

It’s wise to have a real estate lawyer check the contract before signing. The agreement should clearly list all important details. This includes when things are due, how much money is involved, and who fixes what.

“Seeking legal and financial advice before entering into a rent-to-own agreement is crucial to fully understand the implications and navigate the purchase process wisely.”

Important legal points in rent-to-own mobile home contracts include:

- Option fees and rent premiums

- Purchase price considerations

- Maintenance responsibilities

- Penalties for late payments

- Terms for contract termination

| Contract Type | Description | Legal Implications |

|---|---|---|

| Lease-Option | Renter has the choice to buy | More flexibility, less commitment |

| Lease-Purchase | Renter is obligated to buy | Higher commitment, potential legal issues if unable to purchase |

Remember, rent-to-own agreements for mobile homes might not be as regulated as traditional home sales. This makes getting legal advice very important. It helps ensure fair and fair terms for everyone involved.

Pros of Rent-to-Own Mobile Homes

Rent-to-own mobile homes are a great choice for those looking for an alternative to traditional homeownership. They offer several benefits that fit different financial needs.

Path to Homeownership for Credit-Challenged Individuals

For those with low credit scores, rent-to-own agreements are a way to own a home in the future. These agreements usually last about three years. This time allows renters to work on improving their credit while living in their future home.

Building Equity While Renting

Lease-to-own options let renters build equity. A part of the monthly rent goes towards a down payment. This helps renters save for buying the home later.

Time to Save for a Down Payment

Rent-to-own agreements give renters time to save for a down payment. With the median home price at $353,900, saving for a 20% down payment is $70,780. Rent-to-own helps save gradually towards this goal.

| Aspect | Traditional Purchase | Rent-to-Own |

|---|---|---|

| Down Payment | Needed upfront | Built over time |

| Credit Score | High score required | Time to improve |

| Commitment | Immediate | Gradual |

| Price Lock | Current market price | Future price agreed |

Rent-to-own mobile homes are a good choice for those who need time to get ready financially. It’s a flexible path that can lead to long-term stability and property ownership.

Cons of Rent-to-Own Mobile Homes

Rent-to-own mobile homes have some downsides. The monthly payments are often higher than regular rent. This is because of rent premiums, which can be 2.5% to 8% of the home’s price. This can be tough for some to manage.

There’s a big risk with lease-to-own mobile homes. If you can’t buy the home at the end, you lose your option fee and rent credits. This fee can be up to 7% of the home’s value. Sadly, up to half of these deals fall through, leading to financial loss for tenants.

Another issue is who pays for repairs and maintenance. In rent-to-own deals, tenants usually have to cover these costs. This can be very expensive for mobile homes.

- Slower appreciation compared to traditional homes

- Risk of the owner defaulting on their mortgage

- Potential for scams in rent-to-own listings

The home’s value might go down during the lease, leading to overpayment. Mobile homes don’t appreciate as fast as regular houses. It’s important to check any rent-to-own deals carefully. You might find better options, like government-backed mortgages, for first-time buyers.

Rent to Own Mobile Homes: Who Is It Right For?

Rent-to-own mobile homes are a special way to own a home. They help people who can’t afford a home yet. Let’s see who benefits the most.

First-time Homebuyers with Limited Savings

First-time buyers often face big down payment challenges. Rent-to-own deals need less money upfront. This helps those with small budgets.

Individuals Working to Improve Credit Scores

Bad credit stops many from getting mortgages. Rent-to-own lets you improve your credit score. You can rent while working on your finances.

Testing a Specific Mobile Home or Community

Some want to try before buying. Rent-to-own lets you live in a community first. You can see if it fits your life before buying.

| Rent-to-Own Aspect | Benefit |

|---|---|

| Down Payment | Smaller initial cost |

| Credit Score | Time to improve |

| Community Living | Test before buying |

| Monthly Payments | Build equity while renting |

Rent-to-own is good for those who expect to get better financially. It’s for people who will make more money or pay off debt. It’s also for those who need time to save for closing costs.

100% of mobile home park customers ask about rent-to-own. This shows it’s a popular choice. Renting a mobile home can make $4,000 a year, benefiting both sides.

Alternatives to Rent-to-Own Mobile Homes

While rent-to-own agreements are tempting, other mobile home financing options are worth looking into. These alternatives offer more flexibility and potentially better deals for those wanting to own a home.

FHA loans are a favorite among mobile home buyers. They ask for lower down payments, sometimes just 3.5%. They also have more relaxed credit score rules. This makes them easier for more people to get.

VA loans are great for veterans and service members. They often don’t require a down payment. This makes it easier for them to own a home.

- Traditional renting while saving for a down payment

- Improving credit scores to qualify for conventional mortgages

- Exploring down payment assistance programs

- Seeking seller financing

For those considering different options, tiny homes or RVs might be more affordable. They’re especially good for first-time buyers or those with little savings.

| Program | Minimum Requirements |

|---|---|

| Home Partners of America | $40,000 annual household income, 50% max debt-to-income ratio |

| Divvy | 550 FICO score, 1-2% of home price as initial contribution |

| Dream America | 500 FICO score, $4,000 monthly household income |

By looking into these alternatives to rent-to-own, potential mobile home buyers can find the best financing for their needs and goals.

Conclusion

Rent-to-own mobile homes offer a special chance for those facing credit issues or low savings. This path to owning a home has many benefits, like lower upfront costs and the chance to build equity. The average mobile home price is $45,000, much less than a traditional house’s $380,000.

Thinking about rent-to-own means you can try out the home first. You also get to secure a purchase price. Lease agreements usually last from one to several years. During this time, a part of your rent goes towards the home’s price.

Mobile homes save a lot on costs, with utilities being about 90% cheaper than regular houses. Yet, there are risks to consider. These include possibly paying more overall, limited control over the property, and losing money if you can’t buy it. It’s important to do your homework and get advice before signing anything.

By looking at your finances and understanding all the terms, you can decide if rent-to-own is right for you. It’s all about making a choice that fits your housing and financial plans.

6 thoughts on “Rent To Own Mobile Homes : Pros and Cons | 10 Powerful Reasons To Consider”