Sara had always dreamed of owning a home. But high real estate prices seemed to block her way. Then, she found mobile homes, priced at an average of $127,250. They offered a cheaper route to homeownership.

However, Sara soon learned that financing a mobile home was different from a regular mortgage. She needed a good Calculate Mobile Home Mortgage to understand this new world.

Like Sara, many Americans are choosing mobile homes for their affordability. But figuring out your mobile home mortgage is key to making a smart choice. This guide will help you through the process. We’ll look at different financing options and find the best rates for your manufactured home loan.

Table of Contents

Key Takeaways

- Mobile homes offer affordable housing with an average price of $127,250

- Financing options for mobile homes differ from traditional mortgages

- Using a mobile home mortgage calculator is essential for accurate budgeting

- Understanding factors like interest rates, loan terms, and property taxes is crucial

- Exploring various loan options can help secure the best rates for your mobile home

Understanding Mobile Home Financing Basics

Mobile home financing is different from regular mortgages. This is because manufactured homes have unique needs. When looking for a manufactured home financing option, knowing the differences is key. Understanding the factors that affect your loan terms is also important.

Differences Between Traditional and Mobile Home Mortgages

Mobile homes often lose value over time. This makes getting loans for older homes hard, especially those built before 1976. Lenders usually ask for a 10-20% down payment for used mobile homes. They also want a minimum credit score of 580.

| Aspect | Traditional Mortgage | Mobile Home Mortgage |

|---|---|---|

| Property Value | Usually appreciates | Often depreciates |

| Loan Term | Up to 30 years | 15-20 years (chattel loans) |

| Interest Rates | Lower | 3-4% higher than traditional |

Importance of Accurate Mortgage Calculations

Using a reliable mobile home loan estimator is crucial for planning your budget. Accurate calculations help you see the real cost of owning a mobile home. This includes things like lot rent and insurance, which are special to mobile homes.

Factors Affecting Mobile Home Mortgage Rates

Several things can change your mobile home mortgage rates:

- Credit score (minimum 620 for Fannie Mae mortgages)

- Down payment (minimum 5% for fixed-rate Fannie Mae loans)

- Age and condition of the home

- Loan type (FHA, VA, chattel, or personal loans)

Specialized lenders like New Horizon Mortgage Concepts offer loans for homes built before 1976. This opens up more financing options for you. Always compare different lenders to find the best deal for your situation.

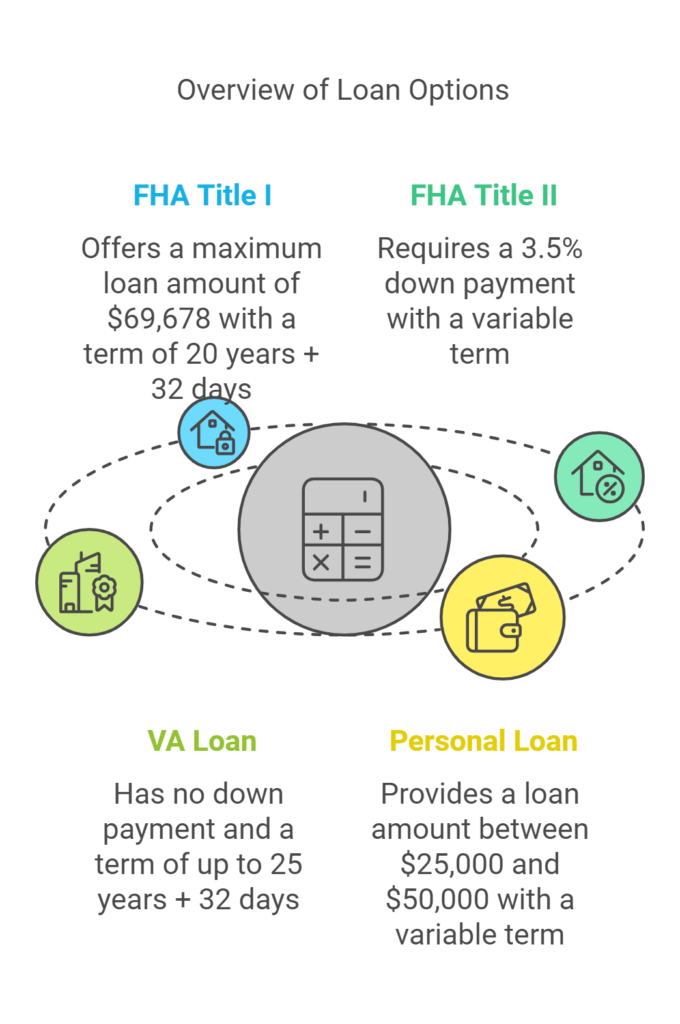

Types of Mobile Home Loans Available

When looking at mobile home loan options, buyers have many choices. Knowing these options helps make smart choices when financing a manufactured home.

FHA Title I and Title II Loans

FHA manufactured home loans offer flexible financing. Title I loans cover new or used homes, with amounts up to $69,678 for single-wide units. Title II loans are for homes seen as real estate, needing a 3.5% down payment.

Fannie Mae and Freddie Mac Programs

Fannie Mae’s MH Advantage program offers 30-year financing with down payments as low as 3%. Freddie Mac has options through Home Possible and CHOICEHome Mortgage programs, meeting different buyer needs.

VA Loans for Eligible Veterans

VA loans give 100% financing to eligible veterans. Loan terms vary based on property type. These loans can last up to 25 years plus 32 days for certain manufactured homes.

Chattel Loans and Personal Loans

Chattel loans are for financing a home without land. Personal loans are an alternative, with amounts from $25,000 to $50,000. Interest rates start around 7.50% for those with excellent credit.

Key Components of Mobile Home Mortgage Calculations

It’s important to know the main parts of mobile home mortgage calculations. A mobile home mortgage calculator or manufactured home loan estimator can guide you through these elements.

Purchase Price and Down Payment

The price you pay for your mobile home affects your mortgage. Lenders usually ask for a down payment of 5% to 20% of the home’s price. For example, a 20% down payment on a $400,000 home in California is $80,000.

Interest Rates and Loan Terms

Interest rates are key in your mortgage. A small change in the rate can mean a lot more in interest payments over time. For instance, a 30-year fixed-rate mortgage in California might have an interest rate of 3.3%.

Property Taxes and Insurance

Property taxes depend on where your mobile home is and its value. Insurance covers loss, damage, and liability. Remember to include these costs in your monthly budget with a mobile home mortgage calculator.

Lot Rent Considerations

If your mobile home is in a community, remember the lot rent. This cost adds up to your monthly housing expenses.

| Component | Example | Impact |

|---|---|---|

| Purchase Price | $400,000 | Determines loan amount |

| Down Payment | 20% ($80,000) | Reduces loan amount |

| Interest Rate | 3.3% | Affects monthly payments |

| Loan Term | 30 years | Influences total interest paid |

By looking at these main parts and using a manufactured home loan estimator, you can better plan your mobile home purchase financially.

Calculate Mobile Home Mortgage: Step-by-Step Guide

Calculating your mobile home mortgage is key to smart financial planning. This guide will help you use a mobile home loan calculator effectively.

First, check your finances. Look at your budget, monthly bills, and how much you can save for a down payment. Knowing this helps figure out how much you can borrow.

Then, collect the needed documents. You’ll need proof of income, credit history, job records, assets, and ID. These are crucial for applying for a mortgage.

Now, use a manufactured home mortgage calculator. Enter important details like:

- Purchase price

- Down payment amount

- Loan term (usually 15-30 years)

- Interest rate

- Property taxes and insurance

- Monthly HOA or lot rent fees

Play with these numbers to see different scenarios. Find the best fit for your finances. Don’t forget extra costs like mortgage insurance, which changes based on your loan and down payment.

| Loan Type | Down Payment | Interest Rate | Term |

|---|---|---|---|

| FHA | 3.5% | 3.25% | 30 years |

| Conventional | 20% | 4% | 15 years |

| VA | 0% | 3.5% | 30 years |

After figuring out your mortgage, think about getting prequalified. It gives you an idea of your loan amount and rate. This helps you know how much you can afford. Finally, a home appraisal and inspection are needed to check the home’s value against the loan amount.

Using Online Mobile Home Mortgage Calculators

Online mobile home mortgage calculators are great tools for figuring out monthly payments and loan costs. They make complex financial math easy. This helps potential homeowners plan their budgets better.

Benefits of Using Online Calculators

A mobile home mortgage calculator gives quick, accurate estimates. You can change things like down payment, interest rates, and loan terms. For example, a bigger down payment can save you thousands on insurance.

Features of Reliable Calculators

When picking a manufactured home loan estimator, look for these features:

- Purchase price

- Down payment

- Interest rate

- Loan term

- Property taxes

- Insurance premiums

- Lot rent (if applicable)

A good calculator breaks down costs like principal, interest, taxes, and insurance. This helps you see the full cost of owning a home.

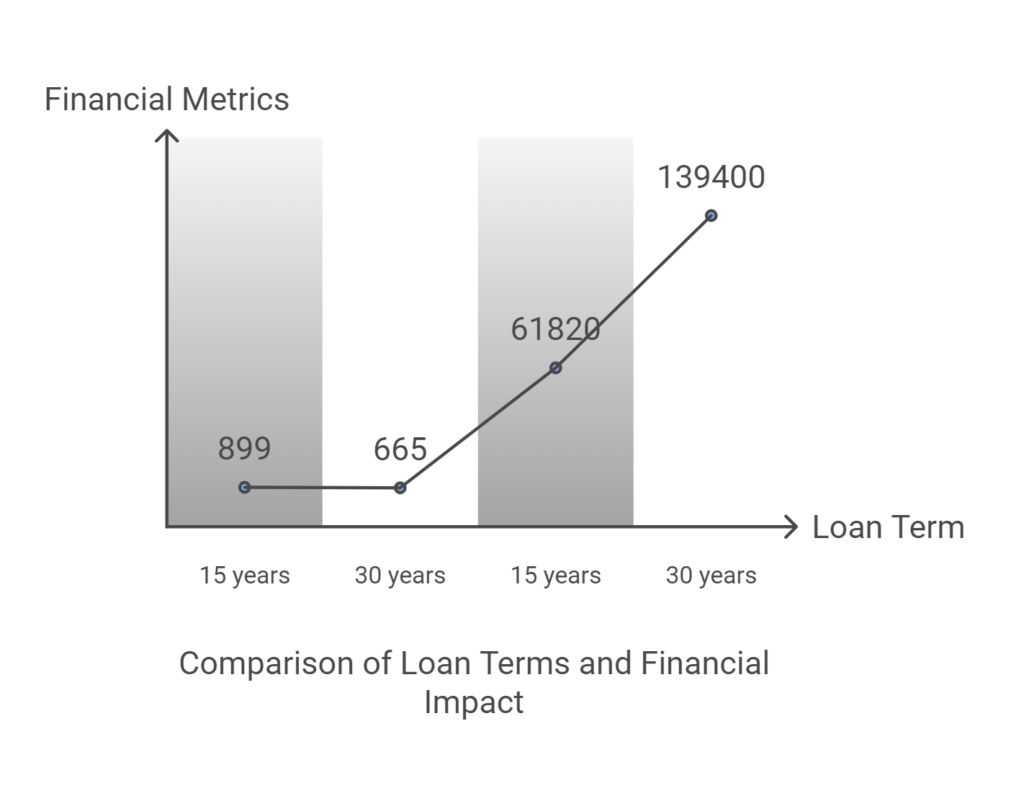

Interpreting Calculator Results

When looking at calculator results, think about how changes affect costs. For instance, a longer loan term means lower monthly payments but more interest paid. Rent-to-own options might be good if traditional loans are hard to get.

Use these insights to make smart choices about your mobile home purchase. Find a loan that fits your financial goals and budget.

Factors Influencing Mobile Home Mortgage Affordability

Several factors affect how affordable mobile home financing can be. Your credit score is key. A higher score means lower interest rates, as lenders see you as less risky.

The size of your loan and its term also matter. Bigger loans have higher rates. Shorter terms mean lower rates but higher monthly payments. A big down payment can lower your loan amount and rates.

The type of loan you get also impacts affordability. Conventional loans need better credit and down payments but offer good rates. FHA loans are for those with lower incomes and better terms. VA loans for veterans often have the best rates and terms, including no down payment.

Where you place your mobile home is important too. Homes on owned land are seen as better than those in leased communities. Interest rates can change due to inflation and the economy.

| Loan Type | Min. Credit Score | Down Payment | Interest Rate | Max Loan Term |

|---|---|---|---|---|

| Conventional | 620 | 3-5% | Fixed/Adjustable | 30 years |

| FHA | 580 | 3.5% | Fixed | 30 years |

| VA | 620 (typically) | 0% | Fixed/Adjustable | 25 years |

| USDA | 640 | 0% | Fixed | 30 years |

Knowing these factors can help you find a good mobile home loan. It’s all about finding what works best for you.

Tips for Securing the Best Mobile Home Mortgage Rates

Getting the best mobile home mortgage rates requires effort, but it’s worth it. Here are some tips to help you secure a great deal on a manufactured home loan.

Boost Your Credit Score

Your credit score is key to getting good rates. Pay bills on time and cut down your debt. A higher score can lead to better best mobile home mortgage rates. For instance, conventional loans for mobile homes need a credit score above 620.

Compare Lenders

Don’t accept the first offer you get. Look around and compare rates from different lenders. A study by Freddie Mac shows getting at least two quotes can save you about $600 a year. Getting four or more quotes can save you over $1,200 yearly.

Consider Loan Terms

Think about different loan terms. Shorter terms like 15-year loans have lower rates but higher monthly payments. They can save you money in the long run. Also, look into government-backed loans. FHA, USDA, and VA loans might offer better terms for those who qualify.

Down Payment and Points

A larger down payment can help you get better rates. Some loans allow down payments as low as 3-5%. Also, consider buying mortgage points. Each point costs about 1% of your loan amount and can lower your rate by 0.125% to 0.25%.

| Loan Type | Minimum Down Payment | Credit Score Requirement |

|---|---|---|

| Conventional | 3% | 620+ |

| Fannie Mae Standard | 5% | Varies |

| Freddie Mac Home Possible | 5% | Varies |

| FHA | 3.5% | 580+ |

| VA | 0% | Varies by lender |

Remember, there are over 2,000 homebuyer assistance programs nationwide. These could help you with down payments or closing costs, making your mortgage more affordable.

Common Pitfalls to Avoid When Calculating Mobile Home Mortgages

Exploring mobile home financing can be tricky. Many buyers face financial strain due to common mistakes. Let’s look at some common pitfalls and how to steer clear of them.

Overlooking Additional Costs

One major mistake is forgetting extra expenses. These include property taxes, insurance, lot rent, and maintenance. For instance, mobile home parks often charge high fees for lot rentals, affecting your budget.

Misunderstanding Loan Terms

Not understanding loan terms is another common error. This includes fixed and adjustable rates, prepayment penalties, and balloon payments. Remember, loans for mobile homes cover only the structure, not the land.

Ignoring Credit Score Impact

Your credit score is key to getting good loan terms. Scores below 580 can make it hard to qualify, while scores above 670 are better. Ignoring your credit score can lead to higher rates or even loan rejection.

| Aspect | Impact |

|---|---|

| Down Payment | Often less than 5% of purchase price |

| Credit Score Requirement | Generally above 580, preferably 620+ |

| Bank/Credit Union Down Payment | 10%-20% (3.5% with FHA loan) |

| USDA Loans | No down payment, 100% financing |

Understanding these pitfalls can help you make better choices. Always consider all loan aspects and your financial situation before buying a manufactured home.

Conclusion

Understanding mobile home mortgages can seem tough, but with the right info, you can make smart choices. This guide has covered key points about financing manufactured homes, from different loan types to how to calculate them. Each financing option has its own needs and perks.

FHA, VA, and conventional loans give you various chances to own a home. For example, FHA Title II loans let you buy both the home and land. VA loans have great terms for veterans. Fannie Mae’s MH Advantage® program offers low down payments for certain homes.

When figuring out your mortgage, remember all the costs. Closing costs usually range from 2% to 5% of the loan amount. Use online tools to guess your monthly payments. But, also think about property taxes, insurance, and lot rent. By following these tips, you’ll find the best mortgage for your new home.

The secret to success is doing your homework, planning well, and working with trusted lenders. Whether it’s a mobile, manufactured, or modular home, knowing your options and duties leads to affordable home ownership. With the right strategy, owning a manufactured home can become a reality.

4 thoughts on “Calculate Mobile Home Mortgage: How to Calculate Your Mobile Home Mortgage ?| A Complete Financial Guide”